FRIENDS AND ENEMIES

Are you sure, I mean REALLY SURE, that the economy is that bad? Or is it possible that it’s just you? That you’ve imagined all of this, in some kind of odd fever-dream, and that things are really just gucci as the kids say (they might start saying something else soon, given that saying gucci won’t help you find a job or a house)? Very odd question if you ask me, but one posed by our friends at the WSJ over the last week. I admit that they do come to some of the same conclusions that a sensible market participant would arrive at, but not nearly enough of them. I’m not sure about you guys/girls, but in my own life I see the number of dollars being spent on things like food, shelter, energy and more all increasing, while the number of dollars I can save, invest or blow on PS5 games that I’ll never play because I have no friends to play with go down.

I’m not sure about you, but imagining things are fine seems like about as good an idea as The Lost Boys imagining themselves a veritable buffet during that one part of the Robin Williams Peter Pan movie. Here’s the thing though – I can’t eat the imagined food, I can’t live in the imagined house, and I sure can’t warm my hands and bottom on an imaginary fire, or drive an imaginary car.

Good luck out there, I guess. Without further ado, let’s get into the round up.

Canadian Unemployment Data Comes In Softer Than Baby Shit

Nothing surprising here unless you’re a professional economist or member of the media, since we know at CBP that the economic data is so poor even as it’s massaged almost to the point of climax. There’s a lot of meat on the bone here. The rate of unemployment debuted it’s new 6 handle coming in a 6.1%, up from 5.8% in February. The data shows that the economy shed approximately 2200 private sector jobs, fine, whatever, but the devil is in the details here and – in keeping with last week’s theme from Ms. Roger’s Halifax speech – the data and those analyzing it for a living are starting to say the quiet part out loud:

The spike in the unemployment rate – a full percentage point higher than where it stood a year ago – is tied to an additional 60,000 people looking for work or on temporary layoff in March, StatCan said. Last month the agency reported that, as of Jan. 1, Canada’s annual population growth hit its fastest rate since 1957.

Whoops! Don’t forget that – as you know – we’ve been fed a story about immigration that turned out to be completely made up. Our immigrants have, overwhelmingly, been a net drag on the economy, taking low wage jobs from entry level Canadian workers, driving down wages, using social safety nets without paying into them, and increasing market-relevant data like unemployment which has it’s own set of secondary effects on the Canadian economy and Loonie value both domestically and abroad.

BUT WAIT, THERES MORE

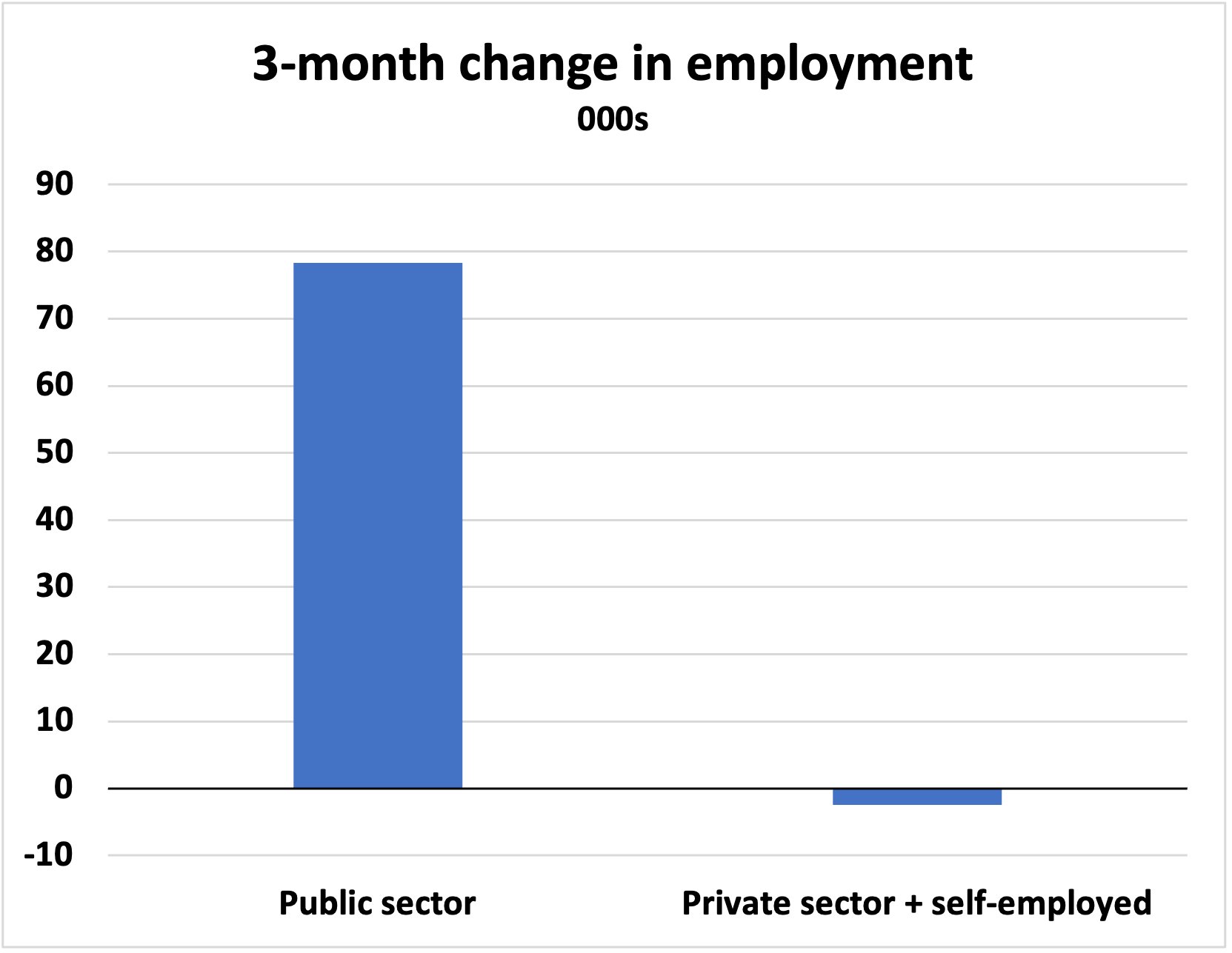

From yet-to-be-guest Ben Rabidoux, a chart outlining the last three months of QUOTE UNQUOTE GROWTH in the Canadian job market. Please find a place to sit down before viewing.

Brothers and sisters in Christ, how can this be? It turns out that, in Canada, we aren’t actually growing at all. We’ve discussed in past episodes that something in the neighborhood of 22% of Canadian employment is in the public sector – teachers, police, fire, municipal/provincial/federal public service, nursing, whatever. Add to that nearly 5% of all Canadians receiving some form of government assistance, and you’re at nearly 1/3 of the entire population QUOTE UNQUOTE EARNING their living from the government. We could go even deeper, and remove the seniors from the equation, and you’d wind up with some staggering piece of the employment pie actually just receiving government cheques. How’s that for growth? For risk? Well, let’s check the Loonie – as friend of the show Keith Dicker mentioned, foreign markets will price risk in Canada via the CAD against other currencies.

As the French say: Dogshit. The downside of this chart is that there’s not really any such thing as a triple bottom, so we’re going to fall through the floor here. The bright side is that you will soon get to add another 0.69 currency screenshot to your Mandibles Memes folder – huge, love that for you.

Central Banks are LOADING Up on Gold

Have you seen the price of gold, anon? Huge moves almost daily during the past week, and the price sitting comfortably above $2300 at the time of this writing. Another yet-to-be-guest Martin Armstrong has something to say about the price pressure and, more specifically, nation states adding their weight to that price pressure via central bank gold acquisition.

The West has become extremely aggressive in its geopolitics. You simply do not buy the debt of your enemy. Central banks are buying gold because the USD is political.

Consider that in the past 3-4 years, we’ve seen anything but impartiality and apolitical behavior from nation state actors in terms of financial rail restrictions. In Canada, truckers and some of their sympathizers had their assets and accounts frozen, Russia was removed from SWIFT, and even had their assets seized. The veil of impartiality has been completely lifted for any competent observer, and so the natural next step is buying and holding assets that are free of this political counterparty risk – Gold naturally fits this description (though not as well as Bitcoin, but I’m biased). In China, for example, the PBoC added a whopping 225 tons of gold in 2023, nearly 25% of all central bank buying, even adding another 22 tons in January and February of this year – fitting, of course, given that the US has formally identified China as a threat to it’s global dominance agenda. Even more, the gold/rates ratio has been torched – typically gold would show weakness in a high rate environment but, like Bitcoin, the relationship seems to have been turned on it’s head as risk outweighs traditional correlations in this new paradigm.

Gold price does one of two things as it rises, depending on which camp you’re in – it either protects against inflation worry/strain, or it protects against global political turbulence. In either case Bitcoin should also perform well – as Zoltan Pozsar once said, the shift to outside money is undeniable and accelerating.

Thinking About Debt and Assets in the US

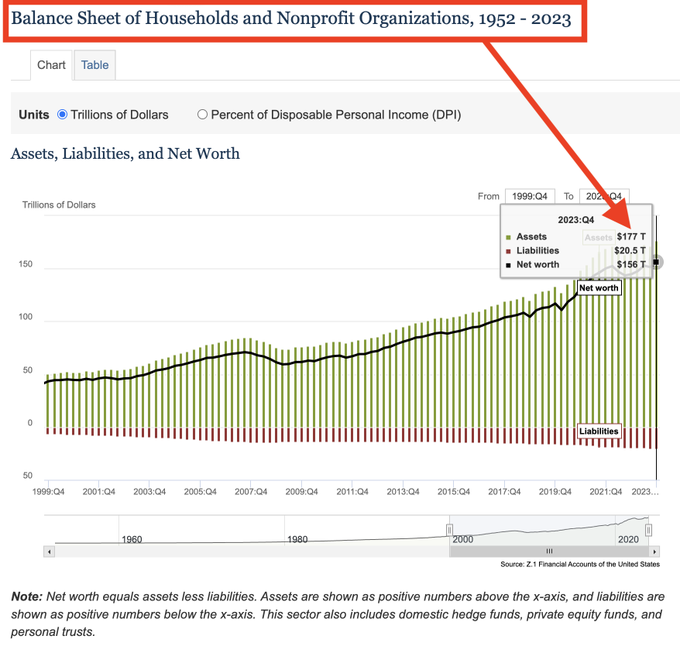

Balaji, the man who brazenly (for clicks) predicted 1M Bitcoin inside of 90 days a lot more than 90 days ago is back it again w̶i̶t̶h̶ ̶t̶h̶e̶ ̶w̶h̶i̶t̶e̶ ̶v̶a̶n̶s̶ with the bomb-ass tweets about debt, assets and the canyon sized gap between the two. Did you know that there’s at least some possibility that the US government views the debts it’s racked up slaying foreigners with COD killstreaks and pumping the SPX as the responsibility of the US taxpayer! Same, same, but they might! Balaji notes that even by the US government’s own admission, the $37tn debt number bandied about doesn’t even come close to covering the actual nature of Leviathan’s balance sheet – the total including unfunded liabilities (the only kind, really) is actually closer to $175tn – that’s not much, is it? Just about enough that if you went back in time that many seconds you’d be looking in the mirror at this guy, which also happens to be the last time someone at your Thanksgiving dinner didn’t have something dumb to say about inflation. It’s a lot.

The title of the tweetstorm really says it all – All It Takes is All You Got – the idea that the debt isn’t really that much so long as every man, woman and child gives up all their savings and assets to the US government so they can keep raining down hell in countries you can’t find on a map for oil that you can’t even use because soon you’ll be whipping around a 15-minute city in your EV hoping your social credit score is high enough to snipe the last lab-grown gerbil steak at the grocery store.

Outstanding, medium-rare please, with sparkling water.

See ya Monday night.

Joey