By: Wayfaring Bitcoiner (@wayfaring_BTCer) for CBP Media

What a way to start the week. As we barrel toward a new ATH, those of us playing this game the right way – by humbly stacking sats and holding them safely in cold storage – are blissfully watching the price chart as one green candle after another pops onto the screen. I’m sitting at my desk with my third cup of coffee and a reverse seared t-bone steak, shitposting on twitter and ignoring texts from people who told me to sell at $16k (kick rocks, losers). And to think, the halving hasn’t happened and the Fed hasn’t even started to cut rates yet. Wew lad.

But imagine for a moment that you haven’t been playing the game the right way. Sure, you’ve been buying bitcoin, but this cold storage stuff? Far too advanced (cue up memes of the TalksFinance guy who can’t comprehend how anyone could possibly remember 24 words). So you keep your sats on an exchange – let’s say, Coinbase. What could go wrong? They’re a publicly traded company. They have a market cap of $55bn. There’s basically no risk keeping your bitcoin here…right?

Wrong. In the midst of bitcoin’s inevitable march to a new ATH, Coinbase has crashed multiple times over the last few days. On February 28th, as bitcoin breached $60k like a S.W.A.T. Team breaching a shower curtain hung across a doorway, Coinbase users excitedly opened the app to check on their stacks (and probably to take screenshots for tiktok videos). To their surprise, their balance read zero!

Coinbase Support was quick to ensure all users that their assets were safe, and that “increased traffic” was to blame for these zero balance display errors.

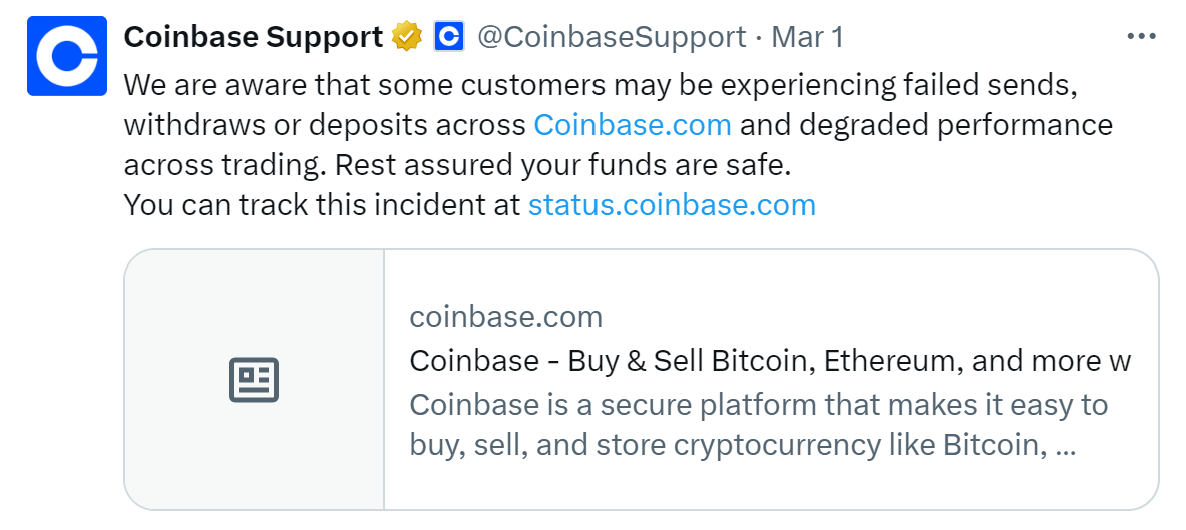

But that wasn’t the end of Coinbase’s technical struggles. Just two days later, on March 1st, they reported degraded performance and failed sends, withdrawals, and deposits.

And yesterday, March 4th, as bitcoin approached 69 with the confidence of a well-groomed and long-tongued gentleman, users again reported seeing zero balances and were experiencing “latency issues” across the platform.

This many technical difficulties over just a few days? At this point Coinbase is crashing more than Boeing’s 737 MAX. Fortunately for you, you can get off of Coinbase without jumping out of a plane at 16,000ft after seeing a piece of the fuselage explode off of the side. Getting your funds off of an exchange and into self-custody is actually incredibly easy. Bull Bitcoin (@BullBitcoin_) has a great guide on self-custody and can even help you out if you’re struggling to do it on your own.

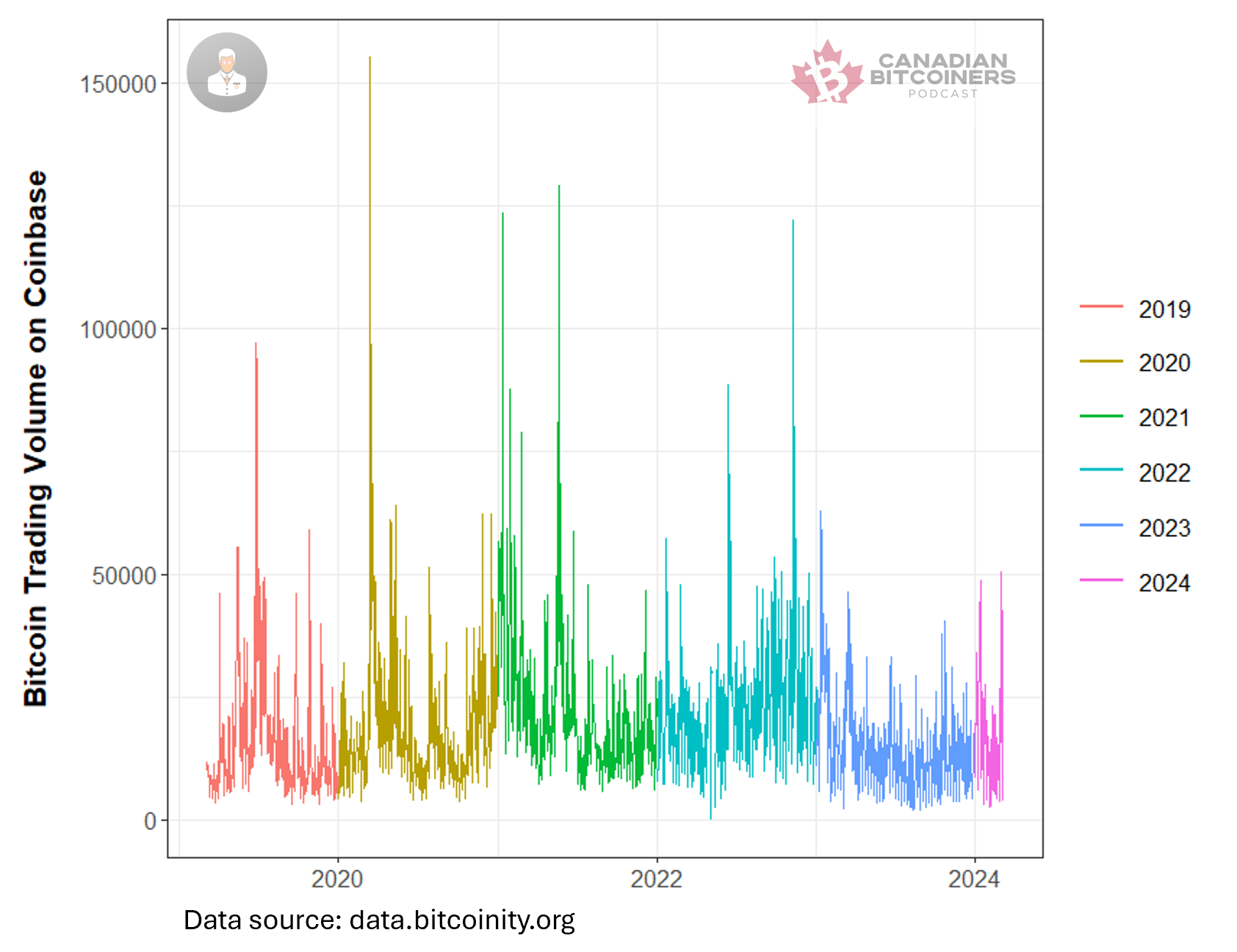

But back to Coinbase. To my knowledge, no one has reported any funds actually missing, which is good. But you have to stop and ask yourself: is a company of this size, experiencing this many issues, really a trustworthy custodian of your money? They claim that increased traffic is to blame, but recent price swings – and their correlated swings in trading volume – are not new. Take a look at trading volume on Coinbase over the last 5 years (data courtesy of data.bitcoinity.org):

The data show that trading volume on the platform regularly reaches levels higher than those experienced over the last several days. Look, I’m not here to tell you that autoscaling services is easy. It’s not. But I am here to tell you that Coinbase – a company with over 3,400 employees (as of December 2023, after multiple rounds of layoffs), a market cap of $55.5bn, an average of $154bn in volume traded quarterly, and the self-proclaimed “future of money” – ought to have this figured out.

They were founded in 2012. By 2014 they had over a million users. By the end of 2020, they had 41 million users and grew to 89 million users by the end of 2021. In terms of volume, they’re the top exchange in the U.S. and one of the top exchanges worldwide. For crying out loud, this platform was chosen as the custodian for 8 of the 11 new spot bitcoin ETFs! If Wendy’s can dynamically change prices based on burger trading volume, then Coinbase ought to be able to handle swings in Bitcoin trading volume.

Yet they crash due to “increased traffic” in response to price and volume patterns that we’ve seen in the past? Make this make sense for me. They’re either technically incompetent or something more sinister is occurring (I’m not alleging anything). Either way, this should be a sign for you to get your sats off of their platform and safely into cold storage.

Every exchange that’s collapsed over the last several years told you that your funds were safe. They weren’t. Don’t let it happen again.

Stay safe out there.

WF