Why do I need 5 different payment apps?

Bitcoin Scribe (@BitcoinScribe)

Let me set a familiar scene:

You’ve just finished dinner with several friends. Wine bottles and large plates littered with empty t-bones are scattered across the table. The waitress asks how you’d like to split the bill. Knowing the absolute chaos a bill split 5-ways will cause (it really shouldn’t be this difficult, but as western society slips further down the slopes everyone promised weren’t as slippery as you’d warned, even the most elementary tasks have become onerous), you tell the waitress, “one check, please.” After you pay, you look at your friends and utter a phrase I’m ashamed has become common vernacular in our society: “you can just Venmo me.”

Friend 1: I don’t have Venmo. Can I CashApp you??

Friend 2: I don’t have Venmo either, but I can pay you over Snapchat.

Friend 3: I saw an ATM outside – I’ll grab you cash when we leave. By the way, I’ll need to take out a round number – any chance you’ll be able to give me change? Also, I’m going to subtract the ATM fee out of what I owe you.

Friend 4: No Venmo for me either. I think I can send you money with Zelle.

*Side note: friends 2 and 4 are the worst. Cut them out of the group immediately. They probably ordered side salads with dinner.

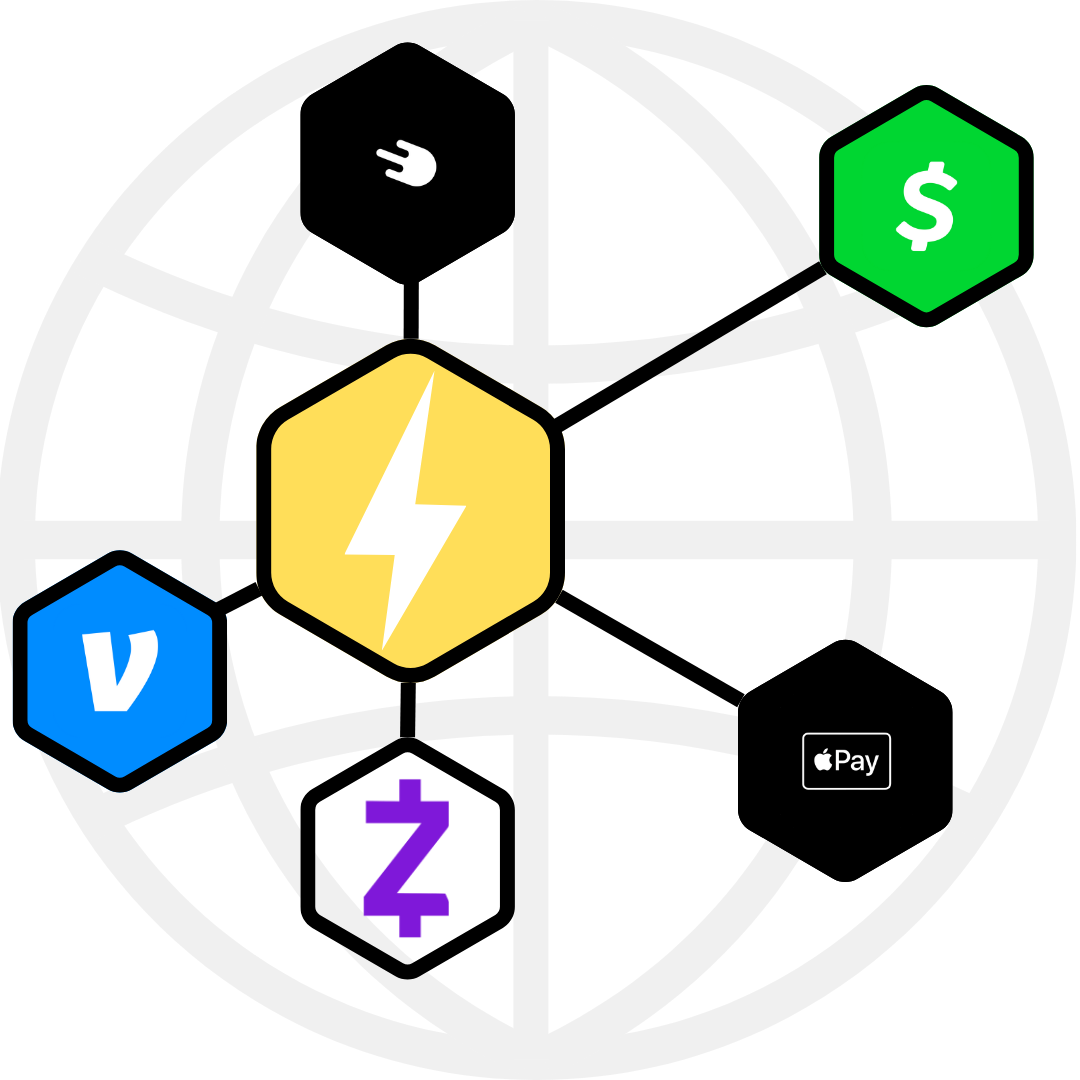

It’s 2024 and yet, despite the meteoric rise of almighty ”FinTech,” we all need five different payment apps to split a dinner bill. Take my phone, for example. I have CashApp, Venmo, Zelle, and Strike (I also apparently have the ability to send cash over iMessage via Apple Pay, but I’ve never tried to do so). While they each have unique features, they all serve the same purpose for me – they’re digital wallets that facilitate peer-to-peer USD payments.

But here’s the caveat: they don’t let you send money (USD anyways) across apps. I can’t, for example, send dollars from my CashApp account to my friend’s Venmo account. Hell, I can’t even send dollars from my CashApp account to my own Venmo account. To do so, I would need to withdraw the dollars from CashApp into my bank account (often with some delay or “instant” availability fee) and then deposit those dollars from my bank into Venmo (also often with some delay or fee).

The point is simple: there is no direct interoperability between the apps. Each app works inside of its own closed network, requiring users – us – to have 5 different apps serving the same purpose. FinTech as an ecosystem remains dominated by closed-network applications.

An Alternative to Closed Networks: Open Networks

The alternative to closed networks, of course, is open networks. Imagine for a moment that all payment apps worked on an open network, allowing users to send funds to one another, even if they’re using two different apps. As a user, you are now in a marketplace of applications that can all “talk” to each other. You no longer need Venmo and CashApp – you can pick whichever you like best based on whatever criteria you place value on. Like that you can buy stocks on CashApp and not Venmo? Use CashApp. Like that you can send money from the U.S. to Africa on Strike but not CashApp? Use Strike. Like Zelle for…I actually have no idea what there is to like about Zelle.

For open networks like these to function, the intermediary protocol that governs transactions between apps needs to be one that each party has access to and trusts. Fortunately for us, we have an example of such a protocol – one that we’ve been using for decades. Let’s take a moment to learn about email.

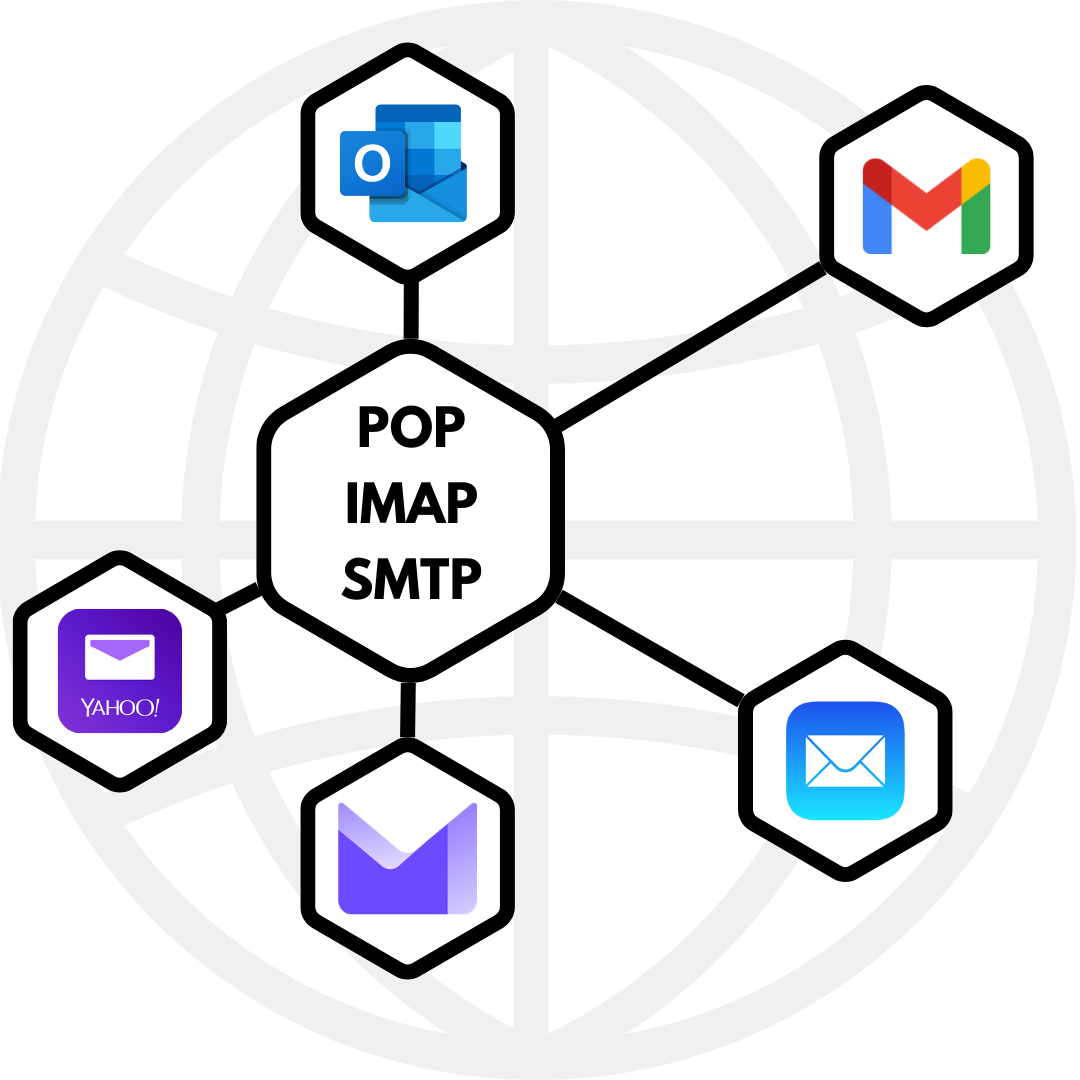

Email as an inspiration for open networks

Email, as simple as it seems, is a great example of the power of an open network built on protocols. The invention of email is largely, but not solely, attributed to Ray Tomlinson, who in 1971 developed a program that allowed people to send messages between connected computers – in this case, the computers were connected on the ARPANET system, a government-funded project that became the world’s first workable prototype of the internet. By the mid-1980s, three protocols were developed to make sending and receiving emails simpler and enabled emails to be exchanged between various clients.

The Simple Mail Transfer Protocol (SMTP), Internet Message Access Protocol (IMAP), and Post Office Protocol (POP) are open protocols that define the rules and standards for exchanging emails between various servers and clients. Amongst other things, these protocols standardize how a message must be encoded, sent, received, and rendered, ensuring that email is a reliable and universally accessible form of digital communication. All clients that want to operate on what we know today as “email,” must adhere to the rules and standards defined by these protocols. Because of this, users have the freedom to use the email application of their choice, based on their own preferences, without worrying about which application their counterparties are using.

*It’s worth mentioning too, that these standardized protocols make it much easier to design and create email clients.

Because of these protocols, I can use my gmail account to send an email to a friend who uses Proton Mail – we don’t need to be on the same client for the message to propagate. Email’s open network exists because SMTP, IMAP, and POP protocols allow reliable, standardized, cross-client communication. Imagine how many different email accounts you would need if email worked like today’s payment platforms. It would be a nightmare.

So, we figured out how to exchange digital messages over email in an open network in the 1980s. And yet, nearly 45 years later we’re struggling to do the same with payments? What a joke. Fortunately, we have the protocols needed to fix this: Bitcoin and Lightning.

Bitcoin and Lightning as Open Protocols for Payments

Just as SMTP, IMAP, and POP serve as protocols enabling email’s open network, Bitcoin and Lightning act as protocols for open network payments. People across the world are already using both networks for global, peer-to-peer BTC transactions, using any number of Bitcoin and Lightning wallets. Payment apps like Venmo and CashApp could also utilize these networks to facilitate cross-platform USD transactions (more on how this would work, at least in theory, below).

Because both networks are open source and auditable, payment apps can essentially treat Bitcoin and Lightning as public utilities that allow for verifiable transactions. Realistically, Lightning would be optimal as the intermediary protocol for “app-to-app” payments. While the Lightning Network offers several other important benefits for payment apps (e.g., mitigating payment reversals), its primary advantages lie in its speed, scalability, and low transaction costs. Transaction volume through these apps is massive – CashApp alone reported a gross payment volume of over $18 billion in 2023 – and people want their money quickly, so scalability and speed are incredibly important.

Here is a general overview of how this would work: Suppose Jerry is using CashApp and wants to send a $10 payment to Tom, who is using Venmo. Jerry sends $10 from his USD balance on CashApp. CashApp converts these $10 into sats and sends them from their Lightning node to a Venmo node. Venmo converts these sats back into USD and delivers the payment to Tom. See, it’s so simple.

I’m not naive. I know I’m oversimplifying how difficult this would be. Establishing and running a fleet of Lightning nodes is no small task. Harder still would be converting cash to sats and sats to cash on the fly. In reality, those conversions likely wouldn’t happen in real time. What’s more likely to happen is that both apps would have pools of BTC on Lightning nodes and pools of USD under custody from which these funds would flow in and out of. Bitcoin quotes would need to be generated on both ends when each transaction occurs so that the correct number of sats is transferred and can be verified by both parties. Nodes and cash pools would need to be monitored and rebalanced (very) regularly and set up in such a way that allows for fluctuations in transaction volume (i.e., automated scalability). Fee structures would need to be thought out and companies would need to take into consideration BTC-USD exchange rate fluctuations when the payment is “in flight.” These are difficult tasks, without a doubt.

But they’re not impossible tasks. Strike is already doing much of this. For years their users have been able to pay Bitcoin and Lightning invoices directly out of their USD balances. The user sends USD, Strike converts it to sats and delivers the payment to the recipient. They also allow their users to issue Bitcoin and Lightning invoices and accept incoming payments as USD. Their Send Global product takes things a step further: U.S. users can send USD to non-Strike users around the world and it will arrive in their bank accounts in the local currency. The U.S. user sends USD, Strike converts it to sats and sends the payment to a partner company in the country of the recipient, where the sats are converted into the local currency and delivered to the recipient’s bank account. Cross-border, cash-to-cash payments, all with Lightning as the intermediary protocol.

While CashApp doesn’t yet provide on-the-fly BTC-USD conversions offered by Strike, they are integrated with the Lightning network. You can already send sats from CashApp to Strike and have it land in your Strike account as USD – we’re so close! If CashApp can implement the same BTC-USD conversion capabilities of Strike, we’ll be golden. Block also owns Square – a point of sale terminal targeted toward small business merchants. Dorsey intends to enable Lightning invoices from Square terminals and allowing merchants to accept incoming Lightning payments as either BTC or USD seems like a no-brainer to me. So Block has multiple lines of business that would benefit from this product (don’t get me started on how great it would be to send musicians payments directly over Lightning on Tidal, another Block-owned company).

If you’re reading this as a Bitcoin maximalist, you’re likely wondering why we don’t just forget about these fiat apps altogether and use Lightning wallets and sats. I get it. I use a Lightning wallet and I wish others would too. But the vast majority of those I typically transact with are not there yet. So, until we’re on a Bitcoin standard, why not use it under the hood to simplify payments and at least move us toward open networks?

If on the off chance that you’re reading this and you happen to be employed by a major payment app that hasn’t yet integrated Lightning, you might consider tossing a note in the suggestion box at work. For help getting started, check out Spiral’s LDK (Lightning Development Kit).

Wrapping Up

So here’s what I want to see, maybe even on a stage at a Bitcoin conference. I want to see Jack Mallers send U.S. dollars from his Strike account to Jack Dorsey, who will receive the payment as U.S. dollars in his CashApp account. On the backend, Strike will convert Jack’s dollars to sats, zap the sats over Lightning to CashApp, where they’ll be re-converted back to dollars before landing in Jack’s account (Jack-to-Jack payments over Lightning). Hell, after the transaction, Mallers can use Primal dot net to post about it and, through the power of nostr (an open protocol developed for sharing text-based information; blog coming soon), Dorsey will be able to show the crowd the post on Damus. Let’s make that happen.

Here’s to open networks. Until next time,

Bitcoin Scribe